Aston Martin in Talks to Tackle $1.4 Billion Debt Pile - Bloomberg

Aston Martin Lagonda Global Holdings Plc shares rose after Executive Chairman Lawrence Stroll confirmed the loss-making British luxury car-maker is negotiating with bankers to address a looming debt pile of roughly $1.4 billion.

Aston Martin in Talks to Tackle $1.4 Billion Debt Pile - Bloomberg

Lenders Ready Up to €1.5 Billion Debt for Applus Take-Private - Bloomberg

Thames Water Offers New Bonds, Plans Buyback to 'Optimise' Debt - Bloomberg

Americanas Closes Deal With Banks to Restructure Debt - Bloomberg

The Oil Was From Iran. The Insurance Was From New York - BNN Bloomberg

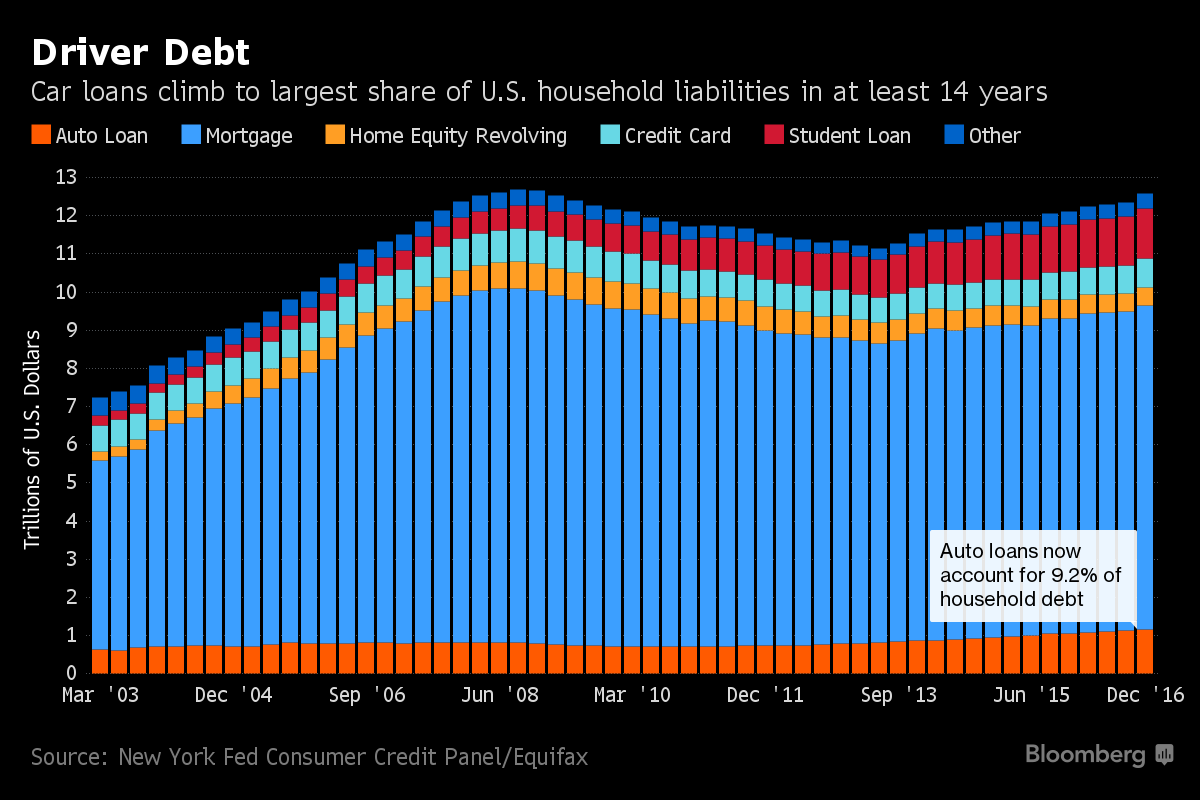

Car Loans on the Rise as U.S. Households Borrow More: Chart - Bloomberg

Aston Martin Scrambles To Tackle $1.4B Debt, Share Prices Surge As Chairman Takes Charge Of Recovery - Lucid Gr (NASDAQ:LCID), Aston Martin Lagonda Glb (OTC:AMGDF) - Benzinga

/cloudfront-us-east-2.images.arcpublishing.com/reuters/GFIH543J3VONROCGRFAVALMBYU.jpg)

Aston Martin to issue $270 million worth of shares to bolster capital

Aston Martin Needs Some James Bond Armor for Its Finances - Bloomberg

Exclusive: Aston Martin considers flying in components, changing ports to handle Brexit delays